Trust Administration

Choosing Between a Revocable Trust and a Will

We have the pleasure of welcoming Candice Blair, a real estate agent from Coldwell Banker Realty.

Read MoreLegacy Letters

We have the pleasure of welcoming Candice Blair, a real estate agent from Coldwell Banker Realty.

Read MoreAvoiding Probate Litigation Through Proper Estate Planning

Estate planning attorney Jennifer Elliott and probate litigation attorney Matt Stein discuss the importance of strategic planning and the creation of an estate plan to minimize the risk of probate litigation.

Read MoreEstate Planning & Real Estate Pitfalls | Podcast & YouTube

We have the pleasure of welcoming Candice Blair, a real estate agent from Coldwell Banker Realty.

Read MoreChoosing a Trustee For Complex Estate Plans | Podcast & YouTube

Estate planning attorney Jennifer Elliott discusses why a professional fiduciary may be a good option for your complex estate plan.

Read MoreEstate Planning 101 | Podcast & YouTube

Jennifer Elliott and guest Michelle Lepich discuss the importance of having a trust, the process and expenses involved in probate court compared to estate planning.

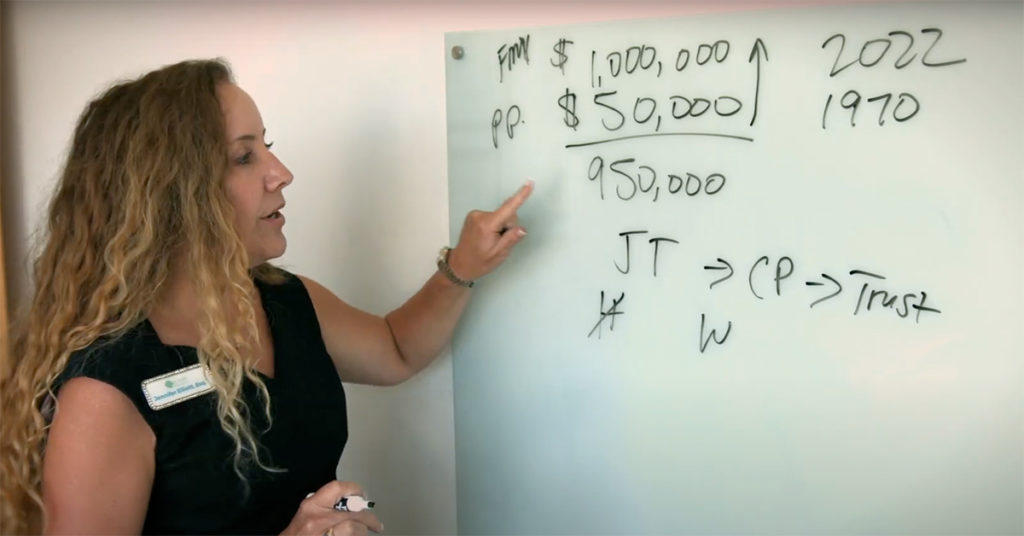

Read MoreEstate Planning to Avoid Capital Gains Tax | Podcast & YouTube

Estate planning attorney Jennifer Elliott discusses strategies to avoid capital gains tax, tips for trustees in administering trusts, why you should not gift real estate.

Read MoreResource Spotlight – How to Avoid Capital Gains Tax

Jennifer Elliott of San Clemente Estate Law explains in simple terms the benefits of a Trust and how to save money on capital gains tax.

Read MoreUsing a Standby Supplemental Needs Trust to Protect Your Loved Ones

It’s best to plan ahead for “just-in-case” scenarios. When packing for our week-long vacation, we might throw in a rain jacket even though the weather forecast is sunny—just in case.

Read MoreElection Update: Prop 19 and Planning under the Biden Administration

Although we await the official certification of the election by each state, an official concession by President Trump, and the outcome of several pending lawsuits–which could take us into December or even January–the 2020 election and its aftermath promise significant changes in how Americans will be taxed.

Read More